Disclosure: This post may contain ad/affiliate links. If you use this link to purchase something, we may earn small commission at no additional cost to you. We appreciate your support. You may read our full disclaimer here.

When traveling locally or internationally, having travel insurance is essential. It provides financial protection against unforeseen events such as medical emergencies, trip delays/cancellations, and lost baggage.

I still remember when we went to Morocco, our baggage went missing during our flight from Bahrain to Morocco. We felt helpless and disappointed about our lost baggage, but there was nothing we could do since we didn’t have travel insurance. Now, whenever I travel, I always make sure to get travel insurance.

Just so you know, this is not a sponsored post. I personally researched travel insurance options available in the Philippines for Filipinos. I have tried and purchased some of these policies myself.

Here’s a simple guide to help you explore the travel insurance options available in the Philippines. I hope this guide helps fellow Filipino travelers choose the right travel insurance for their needs.

Why Do You Need Travel Insurance?

Travel insurance gives you peace of mind by covering unexpected costs during your trip, such as medical emergencies, trip delays, or lost or delay belongings. For instance, if you get sick before your trip and have to cancel, travel insurance can pay you back for costs you can’t get a refund for.

Considerations When Choosing Travel Insurance

Coverage Scope: Make sure the policy includes coverage for medical costs, trip cancellations, lost baggage, and other possible risks related to your travel.

Destination Requirements: Certain destinations, such as Schengen countries, have specific insurance requirements for visa applications. For example, getting a Schengen visa requires a minimum coverage of €30,000 for medical emergencies and repatriation.

Policy Exclusions: Check the policy for any exclusions or limitations, such as pre-existing medical conditions or activities that are not covered.

Premium Costs: Compare premiums from various providers to find a plan that provides thorough coverage at an affordable price.

Top Travel Insurance Providers in the Philippines

AXA Philippines

Smart Traveller provides comprehensive insurance protection whilst you are travelling overseas. Their travel medical insurance protects you from unforeseen accidents as well as provides a broad range of other coverages including travel inconvenience, medical treatment, trip cancellation, travel delay, lost baggage, loss of travel documents and Emergency Assistance Services.

(Source: https://www.axa.com.ph/products/travel-insurance/)

Image source: AXA Philippines Instagram

Smart Traveller Plan type:

- Elite (Schengen accredited)

- Classic (Schengen accredited)

- Essential

Smart Traveller Features and benefits:

- Personal accident benefits

- Travel inconveniences benefits

- Medical and evacuation services

- Personal liability

- 24-hour travel assistance

AXA Smart Traveller just won the Best Travel Insurance (Single Trip) at the 2024 TripZilla Excellence Awards.

To get a quote or to know more detailed information about AXA Smart Traveller travel insurance you may visit their website: https://www.axa.com.ph/products/travel-insurance/

OONA Travel Insurance:

Oona Travel Insurance offers tailored coverage that covers all your needs, starting at just ₱299!

Image source: Oona Insurance PH Facebook

Oona Travel Insurance plans:

- International travel

- Domestic travel

- Flight delay

Oona Travel Insurance plan add-ons:

- Covid-19 protection

- Hazardous sports

- Sports equipment

- International cruise

To get a quote, know more detailed information or to make a purchase of Oona travel insurance online please visit their website: Oona Travel Insurance

MALAYAN Travel Insurance

Malayan Insurance offers two distinct travel insurance plans: Travel Lite and Travel Master.

Malayan Insurance Travel Master is ideal for those desiring extensive coverage, including protection against a broader range of incidents and access to additional services like 24-hour emergency assistance. While Malayan Insurance Travel Lite is suited for travelers seeking essential coverage at a budget-friendly price.

For Travel Master, the traveler aged must be 1-75 years old. For Travel Lite, travel destination must be local or Non-Schengen State or Country.

Image source: Malayan Insurance PH Facebook

Below is a comparative overview to assist you in selecting the plan that best aligns with your travel needs:

Malayan Travel Master Features and Benefits:

- Extensive personal accident insurance

- Emergency medical treatment

- Personal liability

- Coronavirus-19 coverage

- Recovery of travel expenses

- Travel inconvenience benefit

- Travel assistance benefits

- Value added benefits

To get a quote, know more detailed information or to make a purchase of Malayan Insurance Travel Master online please visit their website: Malayan Travel Master

Malayan Travel Lite Features and Benefits:

- Personal accident

- Recovery of travel expenses

- Travel assistance benefits

- Medical reimbursement

- Travel inconvenience benefit

To get a quote, know more detailed information or to make a purchase of Malayan Insurance Travel Lite online please visit their website: Malayan Travel Lite

STANDARD Insurance Travel Protect

Plan Type: Travel International & Travel Local

Travel International

- Cashless Settlement

- Wide variety of benefits and coverages

- Up to Php 2.5M cover for medical expense and personal accident benefits

- Provides coverage for accident-related claims and covered illness/sickness

- Applicable to individual and group of travellers

- Duly accredited by Embassies of all Schengen States

- Pay conveniently using your Credit card, debit card and Gcash

To get a quote, know more detailed information or to make a purchase of Standard insurance Travel International online please visit their website: Standard Insurance Travel Protect International

Image source: Standard Insurance PH Facebook

Travel Local

- Reimbursement type of settlement.

- Up to Php 500,000 limit on medical expense benefit.

- Provides coverage within the Philippines.

- Discounted rates for group travelers.

- Premium payment convenience through credit card and debit card.

To get a quote, know more detailed information or purchase Standard insurance Travel International online please visit their website: Standard Insurance Travel Protect – Local

Source: https://www.standard-insurance.com/products/TravelProtect/index.html

BDO Travel Insurance Promos

They offer 3 kinds of Travel Insurance:

- Domestic Travel

- International Travel

- International Travel Php2.5M

Powered by their insurance partner, Prudential Guarantee and Assurance, Inc.

To get a quote, know more detailed information or purchase BDO Travel Insurance Promos online please visit their website: BDO Promos Travel Insurance

BDO Insure Insurance Plan

- High-end Travel Insurance

- Annual and single trip

- Schengen Visa Accredited

- 24/7 Travel Assistance

To know more detailed information or purchase BDO Domestic Travel Insurance online please visit their website: https://www.bdo.com.ph/bdo-insure/personal/travel

Image source: BDO Unibank Facebook Page

Domestic Travel Insurance

- Get up to ₱1 Million Emergency Medical Treatment benefit

- Inclusive of COVID-19 coverage

- Annual Plan available

To know more detailed information or purchase BDO Domestic Travel Insurance online please visit their website: BDO Insure Domestic Travel Insurance

International Travel Insurance

- Offers 4 different international travel plans

- Premium starts at Php350

- Annual Plan is available

- Powered by BDO’s insurance partner, Prudential Guarantee and Assurance, Inc.

To get a quote, know more detailed information or purchase BDO Travel International Insurance online please visit their website: BDO Insure International Travel Insurance

International Travel Insurance (Schengen Accredited)

- Schengen Visa Accredited

- Enhanced Coverage

- Annual Plan Available

To get a quote, know more detailed information or purchase BDO Travel International Insurance online please visit their website: BDO Insure International Travel Insurance (Schengen Accredited)

BDO Free Travel Insurance:

This is for qualified BDO Credit Cards holder

To know if your eligible to get this insurance please visit their site: Travel Insurance for DBO Credit Card Holder

ETIQA Travel insurance

They offer a Travel Assistance Plan for individuals or families from 0-80 years of age.

Extra COVID-19 coverage is available for individuals and families aged 0–65, applicable only for international travel.

Coverage will start 24 hours before the date of departure and 24 hours after arrival date.

Image source: Etiqa Philippines Facebook

To get a quote, know more detailed information or purchase Etiqa Travel insurance online please visit their website: Etiqa Travel Insurance

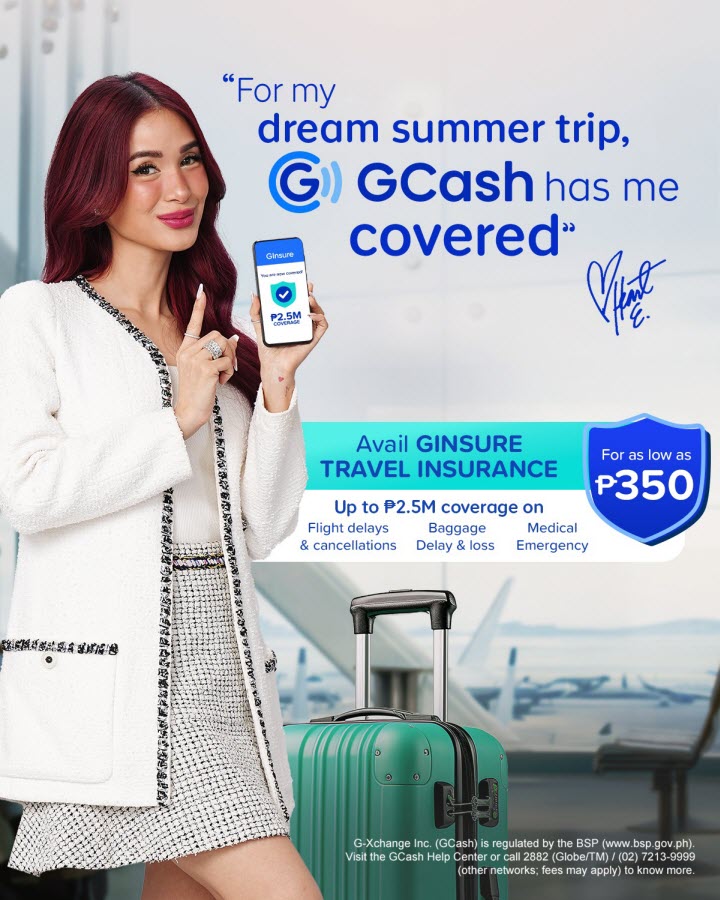

GINSURE also offers a variety of travel insurance plans tailored to meet diverse traveler needs. Ginsure is accessible through the GCash app when using your smartphone, These plans are provided in partnership with reputable insurance companies such as Standard Insurance, Malayan Insurance, and Oona Insurance.

Image source: Gcash Official Facebook

Below is an overview of the options available:

Oona Insular

Smart Flight Delay Insurance

As low as Php149

Coverage: Php10,000

Oona Insular

Infinity Travel Insurance

As low as: Php299

Coverage: Php5,000,000

Standard Insurance

- Travel Protect Saver Plus

- As low as: Php103

- Coverage: Up to 750K

Standard Insurance

- Travel Protect International

- As low as: Php350

- Coverage up to Php2.5M

Malayan Insurance

- Travel Master with Covid-19

- As low as: Php 950

- Coverage: Up to Php2.5M

During my Asian (Thailand, Vietnam and Laos) travel with friends for 13 days – we purchased from Ginsure using Gcash app the Standard Insurance Travel Protect International. It was around Php800+.

When to Purchase Travel Insurance

It’s best to buy travel insurance right after booking key parts of your trip, like flights and accommodation. Purchasing it ahead of time ensures you’re covered for unexpected events that might cause trip cancellations or changes before you leave.

Getting travel insurance is a smart move for any traveler. It offers financial security and peace of mind, so you can relax and enjoy your trip to the fullest.

Take time to evaluate your travel needs, compare various plans, and pick the one that fits you best.

Thise are the various travel insurance options available for Filipinos. With travel insurance, you can travel with confidence. For a reasonable amount, you can secure your trip and enjoy peace of mind.